Last July 4, 2013, I've got a phone call from Ms. Joecy of Philippine Prudential Life that I won a scholarship that is transferable to my siblings, etc. She said I need 2 valid IDs along with my ATM and credit card. To end the conversation shortly I said "OK" thinking I will ask "G" (Google) for advice if it is SCAM or NOT.

So here are the product of my research, closest to what I experienced when I ran some errands in Starmall Show Blvd last June 2013, two weeks prior getting that phone call from Ms. Joecy (member releasing department of Philippine Prudential-09219930531).

Ms. Joecy gave me an address, asked me about my IDs and my ATM/CC...

SCAM or NOT?????

Philippine Prudential Life Insurance Company Promo Scam

August 30, 2012

This isn’t actually a brand new modus but one that has resurfaced recently in Robinson’s Place Ermita, Manila. An internet search of the company’s name turns up results from people in the Visayas and Mindanao who have been tricked back in 2009 and 2010.

“Beware of ladies in green long sleeves and guys in ties who ask you in SM Malls nationwide if you have credit cards. Your initial reaction would be yes as you want to get rid of them thinking that they will offer you some credit cards but think again before you try to brush them off because they will actually bug you more once you say yes! These people work for PPLIC or the Philippine Prudential Life Insurance Company, formerly Family First Insurance, then changed to Danvil Insurance and eventually PPLIC.

Once they know that you have a credit card, ATM card, checkbook or any proof that you have some money that could take away from you, they will be persistent in inviting you over their office by enticing you with their freebies.

If you happen to have seen them in the past and decided to ignore them, please continue to do so. If in any case you’re curious as to what they could offer, I would suggest you to go past through them, stay away from these vultures and go on with your peaceful life. Trust me, your life is way better off them.

Freebies to Lure You Into Listening to their “45-minute” Company Presentation

Once the people in PPLIC or Philippine Prudential Life Insurance Company know that you have credit cards, ATM, checkbook or some hefty cash on hand, they would tell you that you qualify for a raffle stub for a chance to win $10,000, Honda Car and any of their freebies (e.g tumbler, pillow, umbrella, wall clock) which you can claim in their office and committing to a 45-minute presentation. Whether it be for our Filipino nature of being easily enticed with freebies or being too polite, you might have easily gave in to their invitation and walked into their spacious office which typically have a receiving area, a reception who would ask you who invited you over, a flat-screen television and once you enter their “presentation room” filled with table for 3 and presenters who must have just graduated from college, you know that you’ve just gotten yourself into trouble.

The truth is, these people would only sell you some endowment saving scheme and wouldn’t get rid of you until you’d say yes. It doesn’t matter how much time it would take but they definitely try all they can to get you. They are probably the most accommodating people that you will ever meet. They’d shake hands with you, offer you a drink (iced tea or water), and introduce you to a presenter who would talk with you one-on-one about your dreams, about the uncertainty of the future and the importance of saving.”

Submitted by: Gillian Camille

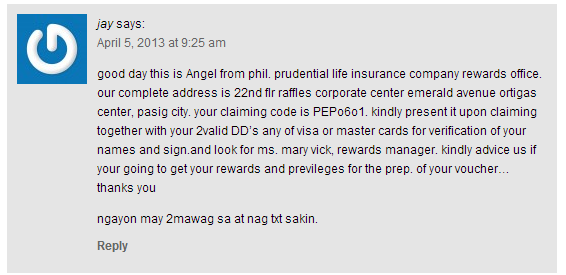

Selected comments from the post..

Other sources:

I'm not saying PPLIC is a SCAM. I'm just saying that I (as in me) experienced the very same thing others experienced. I don't buy their marketing strategy that you can only invest TODAY, not ever.

Really??!! That's really stupid!

People invest in stocks every now and then. People start business after some analysis and considerations. People think for an hour what to eat, some weeks, months, years what HOUSE or CAR to buy.

You just can't let go of thousands of pesos in A DAY. What a bad marketing ploy "if you don't invest now, you cannot invest ever". Even the best CEO cannot decide in ONE DAY for a long-term investment.

Just BEWARE and BE AWARE!!!

Before doing something you might regret, do some research, investigate and learn from other mistakes.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------

UPDATE! UPDATE! UPDATE!

February 19, 2016

-------------------------------------------------------------------------------------------------------------------------------------------------------------------

UPDATE! UPDATE! UPDATE!

February 26, 2016

07:19 AM

Instead of saying na I'M FROM COMPETITOR think again sir. Why will I published for Philippine Prudential Life Insurance? I know publicity BAD OR GOOD, publicity pa rin. Di sana nag blog na lang ako about SUNLIFE AND PRULIFE and my good experienced with them? Yun nga lang the timeline is OFF because i updated just this month February 19, 2016, whereas I originally published my blog almost 3 years ago last July 4, 2013 to be exact.

It's really good that you satisfied your customers, THE EFFECT - GOOD & POSITIVE FEEDBACK. That's what the universe teaches us so we strive to do good to have a positive effect.

Sa mga gaya kung investment savvy, try to be open minded. If possible go to all companies offering investments, Bank UITFs, Pru Life, Sun Life, AXA, Manulife, BPI-Philam, even Philippine Prudential too. As many as you can, hear them out. Tapos checked them out din, the COMPANY PROFILE, the PERFORMANCE of their products, benefit and charges. You can mixed your investments naman, its good na diversified ung investment portfolio nyo. Invest half to Company X, quarter to Company Y and quarter to Company Z. As the idioms says ""don't put all your eggs in one basket"

No comments:

Post a Comment